An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingLEARN MORE ABOUT EMPOWERRD

About EmpowerRD About EmpowerRD

Our people + platform will support you through the complexity of claiming R&D tax relief.

LEARN MORE ABOUT EMPOWERED

About EmpowerRD About EmpowerRD

learn more ABOUT OUR R&D TAX CREDIT EXPERTS

Streamlining R&D Tax Claims for UK Innovation Streamlining R&D Tax Claims for UK Innovation

In 2017 our founder recognised that the R&D tax claim process was not only complex, but also costly. EmpowerRD then became the first to launch an R&D tax claim platform in the UK, with backing from Forward Partners.

Delivering a hybrid approach of both people + platform, adapting to regulatory change when needed.

2017

Founded

1200+

Clients

30+

Team

£200m

Claimed

learn more ABOUT OUR R&D TAX CREDIT EXPERTS

How We Retain a Low Enquiry Rate of 2.4% How We Retain a Low Enquiry Rate of 2.4%

An experienced team

A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Flexible platform

A flexible platform to adapt to changing regulations.

Chartered & Accredited

One of just 5 members of the Chartered Institute of Taxation’s Professional Standards Working Party.

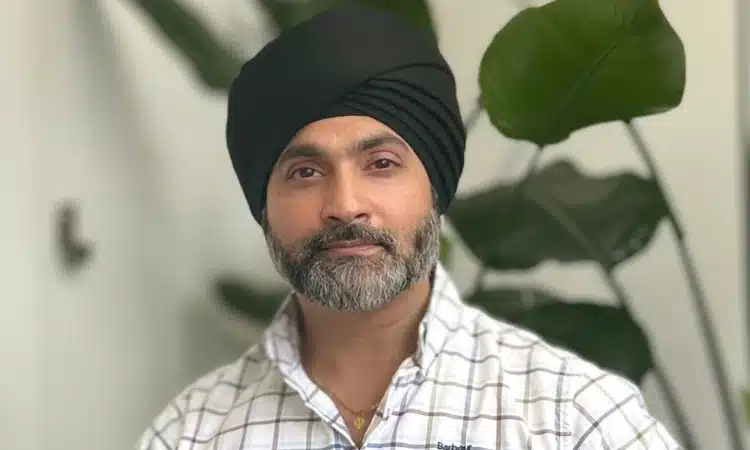

Meet our Leadership Team Meet our Leadership Team

Working at EmpowerRD Working at EmpowerRD

EmpowerRD is based in London in the heart of the Silicon Roundabout. Team collaboration is incredibly important to us and we operate a hybrid working policy, with regular team socials.

If you want the opportunity to be part of our growth journey, check out our careers page.

Talk to an expert

Our clients say

"The online platform made it much easier to co-ordinate between the finance and technical teams."

“EmpowerRD is doing R&D claims the way everyone should be doing it. They absolutely exceeded our expectations and are now one of our long term partners.”

“I was looking for a specialist with a rigorous platform that could handle a complex R&D tax credit claim, because of our grant. EmpowerRD came up on top.”

“Whilst the platform was a real asset for us, the best thing was the support we received. We always had a client success manager on the other end. If we had any questions or concerns, we could use the chatbot, and our client success manager was there to help. It was a breeze; really good support throughout.”

Join our newsletter

Stay informed

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

Useful Links

© Copyright 2025. EmpowerRD. CN 10785149. VAT GB 271357893. All Rights Reserved. Registered office: 5th Floor, Holden House, 57 Rathbone Place, London W1T 1JU.