An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingOne Seamless Experience with People + Platform One Seamless Experience with People + Platform

Our streamlined hybrid approach from application to refund, on average, will only take 8 hours, which is typically 2.5X faster than working with traditional advisors, at only 5% of final credit or less.

R&D TAX CREDITS combining technology & human expertise

One Seamless Experience with People + Platform One Seamless Experience with People + Platform

learn more about the R&D Tax Credits claim process

The Claims Process The Claims Process

Discovery Call

Our experienced claims specialists will walk you through the whole process and make sure it’s clear how to identify projects and what you can and can’t claim.

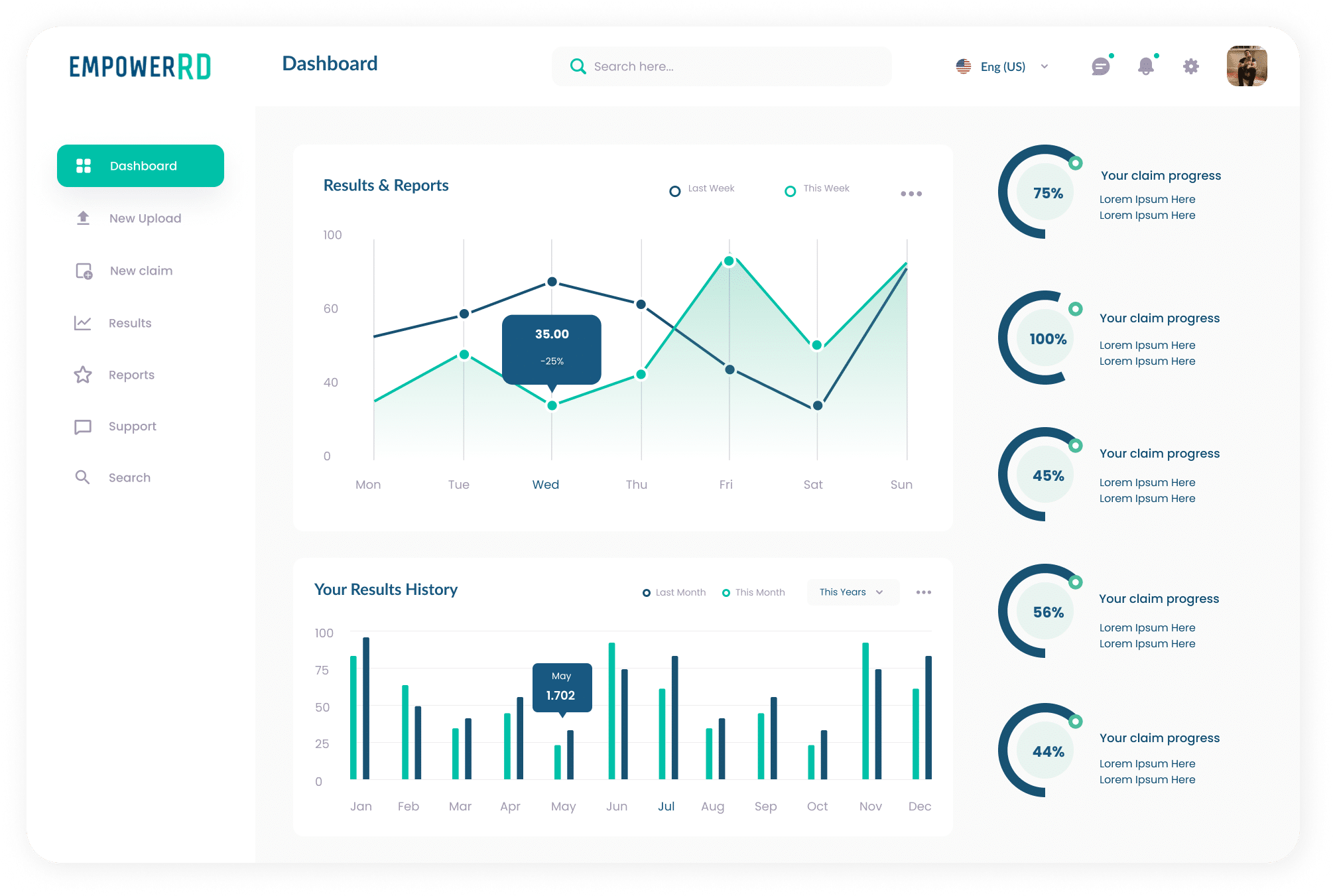

Claims Platform

There are only 8 sections to complete for submission. You can find out more about these sections here.

Review

Our specialist team will carefully review each section for accuracy, compliance, and optimisation. Your dedicated claims manager will discuss benchmarking for cost optimisation. Rest assured, our specialists conduct thorough checks on final applications before submission.

Submission

When you're ready to submit, the platform automates the process by populating your company, cost and technical data into the Additional Information Form which will automatically get sent to HMRC. In addition you can choose to submit the corporation tax return (CT600) yourself or let our team handle that too.

HMRC Follow-up

Our team will chase the correct HMRC departments for updates on claim progress and provide enquiry support if needed.

Tax Credit Received

HMRC will typically pay out within 6 weeks from claim submission.

Learn more about our platform here

Why Should You Choose EmpowerRD? Why Should You Choose EmpowerRD?

Our platform + service takes away the complexity of claiming R&D tax relief.

Trusted by

1,200+

customers with a total

claim value of

£200m+

2.5X faster than traditional advisors

Up to 4X more cost-effective: 5% or less of final credit back

8 hours on average to submit

Reduce risk: 2.4% enquiry rate, with just only 0.3% adjustment

Talk to an expert

Our clients say

"The online platform made it much easier to co-ordinate between the finance and technical teams."

“EmpowerRD is doing R&D claims the way everyone should be doing it. They absolutely exceeded our expectations and are now one of our long term partners.”

“I was looking for a specialist with a rigorous platform that could handle a complex R&D tax credit claim, because of our grant. EmpowerRD came up on top.”

“Whilst the platform was a real asset for us, the best thing was the support we received. We always had a client success manager on the other end. If we had any questions or concerns, we could use the chatbot, and our client success manager was there to help. It was a breeze; really good support throughout.”

Join our newsletter

Stay informed

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

Useful Links

© Copyright 2025. EmpowerRD. CN 10785149. VAT GB 271357893. All Rights Reserved. Registered office: 5th Floor, Holden House, 57 Rathbone Place, London W1T 1JU.