An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingWelcome to the future of claiming

Robust R&D claims, built by experts, EmpowerRD by technology

Take the pain out of building a compliant and optimised R&D claim by combining both expert human oversight and a next-gen collaboration platform.

Proudly supporting over 1,200 UK innovators

£0+

of UK R&D contribution to the UK economy uncovered

0+

Clients served

£0+

In successful claims awarded

<0

All time HMRC enquiry rate

Assisting you throughout

your R&D journey

Guided by experts

The claims process can be daunting with a number of uncertainties. Our team of experts will guide you through the process assisting with narrative drafting and provide support if an enquiry arises, helping you avoid common mistakes and errors.

Learn more

Keep more of your claim award

Our market-leading rates are 5% for claims exceeding £80,000 and a flat fee of £4,000 for smaller claims. We’re able to do this as our platform and tax experts work together to streamline the claims process. What’s more, payouts can be in as little as 6 weeks from submission.

Enquiry support as standard

We have an enquiry rate of less than 5%. However, should one arise, EmpowerRD’s Tax Advisors will support you throughout the process liaising with HMRC on your behalf.

Become tech-empowerRD

By leveraging our collaboration platform and expert advisors, EmpowerRD simplifies and speeds up the claims process, ensuring SMEs optimise their claim without the need for extensive in-house expertise or resources.

Learn more

Broad experience

With over 1200+ clients served, our team are well versed in supporting R&D Intensive companies and those claiming through the RDEC scheme.

Learn more

White-glove account management

Where required, claims will be allocated a dedicated claims manager that will guide you through the submission process from initial consultation through to award.

In-depth knowledge

Our team of Tax experts include ATT-qualified professionals, ex-HMRC inspectors, and PhD-technical experts who are on hand to support your claim.

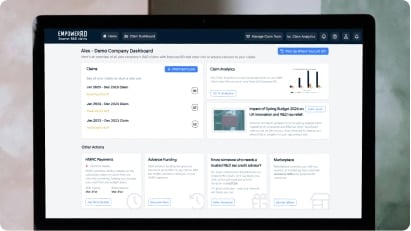

Full transparency of your claim

We put you in the heart of the claim with instant access to all your data pre and post submission. Including historical claim information and outcomes.

Learn more

The UK Innovation Report 2025

What 750 UK founders, scale-up leaders and investors reveal about the trends, barriers and opportunities shaping R&D, and how to thrive in the changing R&D landscape.

As featured in:

Awards & accolades

🏆 Ranked #1 in TechRound's FinTech 50

Meet your R&D

claim experts

While we utilise market-leading technology to deliver for our clients, this is never at the expense of providing a tailored, account managed approach for every claim that we take on.

Customer success team

Our team of customer success managers will be on hand to support you beginning-to-end whilst helping onboard you onto the EmpowerRD collaboration platform.

Claim Quality Team

The claim quality team thoroughly reviews all aspects of your claim, assists with narrative writing before submission, and flags any concerns or areas that need clarification.

Tax Specialists

Our tax specialists, including ex-HMRC staff, are ready to help if your claim needs a closer look and will be able to support should an HMRC enquiry arise.

Claim Drafters

Expert claim drafters will assist in constructing the narrative to ensure its fully compliant with HMRC guidelines.

Innovation Team

Our expert engineers continuously update the EmpowerRD platform to meet the latest HMRC requirements and streamline your claims process.

A free 30 minute call to:

- Discover the scope of your R&D qualifying business activities

- Understand your claim ambitions

- Establish an estimated timeline to receive your R&D tax credit rebate

Expertise meets technology on our claims platform

Robust claims, built through the power of collaboration

How our team and platform works with you to build a strong and optimised claim submission.

Meet your claims

collaboration platform

You’ve met the experts, and you may have watched the product walk-through above, now let us introduce you to the USPs that make our collaboration platform so powerful.

Intelligent collaboration

Expedite your claims

Speed up your claim with real-time data input from your team, anyone from CEOs to finance admins can add data to the claim.

Stay notified

Get live notifications to accurately value your claim and meet HMRC standards.

Secure

The platform ensures strict data privacy with user permissions restricting access to sensitive information.

Quality assured

Our quality team reviews all irregularities, combining platform efficiency with expert oversight to ensure a robust claim.

Claim Data at Your Fingertips

Seamless integration

EmpowerRD's collaboration platform integrates directly with Xero and accepts CSV/spreadsheet uploads.

Precision reporting, in real time

Assign expenditure to both the correct project and period. View your claim value grow as you input your spending into the platform.

Total access, total transparency

All claim data is instantly available, giving you total visibility of your claim.

Compare your claims

View historic claim reports, so you can plan and budget for current and future R&D tax credit rebaits.

Claims made simple

Demystifying

the claims process

Get an overview of our proven R&D filing method.

Kick off call

With our customer success claims manager, we will establish the fundamentals of your claim.

Onboarding

Training and advisory in the EmpowerRD collaboration platform.

Initial costs & narrative

Uploading of expenditure costs and your initial R&D project narrative to the platform.

Claim review kickoff

Claim review phase carried our by our specialist Claim Quality Team.

Narrative drafting

Written narrative drafted and provided for approval by the Claim Drafting Team.

Final checks and sign off

Final checks and approval provided by both client and the Claim Quality Team.

Paperwork submitted

Claim and AIF forms checked by both team and platform and submitted alongside the CT600 to HMRC.

HMRC processing

Claim updates fed directly from HMRC into the EmpowerRD collaboration platform. Additional HMRC follow up carried out by our team.

4. Claim Awarded

You’ll receive HMRC’s award decision in as soon as 6 weeks. Now let’s prep for the next financial year.

Payouts can be received in a little as 6 Weeks from submission to HMRC

EmpowerRD

success stories

Optimised Bloom & Wild’s R&D claim value

"The online platform made it much easier to co-ordinate between the finance and technical teams."

Streamlined the R&D claim process

“EmpowerRD is doing R&D claims the way everyone should be doing it. They absolutely exceeded our expectations and are now one of our long term partners.”

Handled a complex claim with ease

“I was looking for a specialist with a rigorous platform that could handle a complex R&D tax credit claim, because of our grant. EmpowerRD came up on top.”

Expert support drives claim success

“Whilst the platform was a real asset for us, the best thing was the support we received. We always had a client success manager on the other end. If we had any questions or concerns, we could use the chatbot, and our client success manager was there to help. It was a breeze; really good support throughout.”