Coffee catch-up with founder Hari – Sharing insights into the R&D tax claims landscape

This week, we had a coffee chat with our founder, Hari, to discuss the present and future of R&D tax relief. Hari shares insights on

An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingThis week, we had a coffee chat with our founder, Hari, to discuss the present and future of R&D tax relief. Hari shares insights on

August 2023 – The deadline for your R&D tax credit claim is approaching The August 2023 deadline for submitting your amended CT600 (Corporation Tax return)

From 1 April 2023, the R&D tax relief scheme is undergoing drastic changes. To help you understand what these changes mean for your company’s future

An update from our Chief Client Officer, Max Glennon, on the latest changes affecting the UK’s R&D tax credit scheme. This month: Max looks

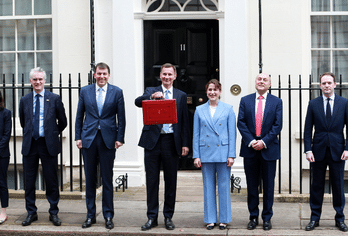

Chancellor Jeremy Hunt’s Spring Budget 2023 supports the government’s economic plan to halve inflation, reduce debt and grow the economy. Highlighting the government’s commitment to

In January HMRC issued another 2,000 nudge letters as they continue to crack down on fraudulent R&D tax claims. Why is HMRC sending out nudge

An update from our Head of Tax, Jon Yeomans, on the latest changes affecting the UK’s R&D tax credit scheme. This month, topics include: Jon

Last year, a House of Lords subcommittee initiated an inquiry into the proposed R&D tax credit scheme reforms. After reviewing responses, they released their final

In response to the announcement of a simplified, single RDEC-like R&D tax credit scheme in the Autumn Statements, HMRC has initiated an 8-week consultation. On

On 22 July 2022, HMRC launched a public consultation entitled ‘Raising standards in tax advice: protecting customers claiming tax repayments’ to guarantee that all taxpayers

As anticipated, HMRC published their draft guidance on 20 December on the R&D tax credit changes affecting accounting periods beginning on or after 1 April

In a letter to the House of Lords Finance Bill Sub-Committee, Victoria Atkins MP explains why R&D anti-fraud measures have been taken so seriously by