R&D tax credit statistics 2023: Reflecting on HMRC’s insights and broader implications

In the wake of economic challenges, HMRC’s recent release on R&D tax credits for the tax year 2021-2022 offers a hopeful narrative on UK businesses’ resilience

An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingIn the wake of economic challenges, HMRC’s recent release on R&D tax credits for the tax year 2021-2022 offers a hopeful narrative on UK businesses’ resilience

Yesterday, HMRC released the Annual Report and Accounts for 2022-23, which unveiled concerning trends of suspected “fraud and error” related to R&D Tax Credit schemes.

This week, we had a coffee chat with our founder, Hari, to discuss the present and future of R&D tax relief. Hari shares insights on

Did you know you can claim money on your innovative projects in science and technology? The UK R&D tax credit scheme is a government incentive

More than ever, record-keeping is crucial when claiming R&D tax relief. Failing to document R&D activities properly may cause eligible costs to be overlooked or

August 2023 – The deadline for your R&D tax credit claim is approaching The August 2023 deadline for submitting your amended CT600 (Corporation Tax return)

From 1 April 2023, the R&D tax relief scheme is undergoing drastic changes. To help you understand what these changes mean for your company’s future

An update from our Chief Client Officer, Max Glennon, on the latest changes affecting the UK’s R&D tax credit scheme. This month: Max looks

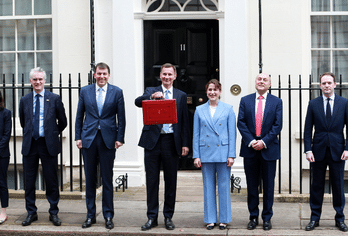

Chancellor Jeremy Hunt’s Spring Budget 2023 supports the government’s economic plan to halve inflation, reduce debt and grow the economy. Highlighting the government’s commitment to

In January HMRC issued another 2,000 nudge letters as they continue to crack down on fraudulent R&D tax claims. Why is HMRC sending out nudge

An update from our Head of Tax, Jon Yeomans, on the latest changes affecting the UK’s R&D tax credit scheme. This month, topics include: Jon

In response to the announcement of a simplified, single RDEC-like R&D tax credit scheme in the Autumn Statements, HMRC has initiated an 8-week consultation. On

"The online platform made it much easier to co-ordinate between the finance and technical teams."

“EmpowerRD is doing R&D claims the way everyone should be doing it. They absolutely exceeded our expectations and are now one of our long term partners.”

“I was looking for a specialist with a rigorous platform that could handle a complex R&D tax credit claim, because of our grant. EmpowerRD came up on top.”

“Whilst the platform was a real asset for us, the best thing was the support we received. We always had a client success manager on the other end. If we had any questions or concerns, we could use the chatbot, and our client success manager was there to help. It was a breeze; really good support throughout.”

By subscribing you agree to with our Privacy Policy and provide consent to receive updates from our company.

© Copyright 2025. EmpowerRD. CN 10785149. VAT GB 271357893. All Rights Reserved. Registered office: 5th Floor, Holden House, 57 Rathbone Place, London W1T 1JU.