An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingThe EmpowerRD Blog

Insights and ideas to enrich your innovation, navigate the complex funding landscape, and enhance the quality of your R&D tax credit claims.

Investor insight: Why 92% say R&D is vital to growth

The UK Innovation Report 2025 – 5 things every founder needs to know

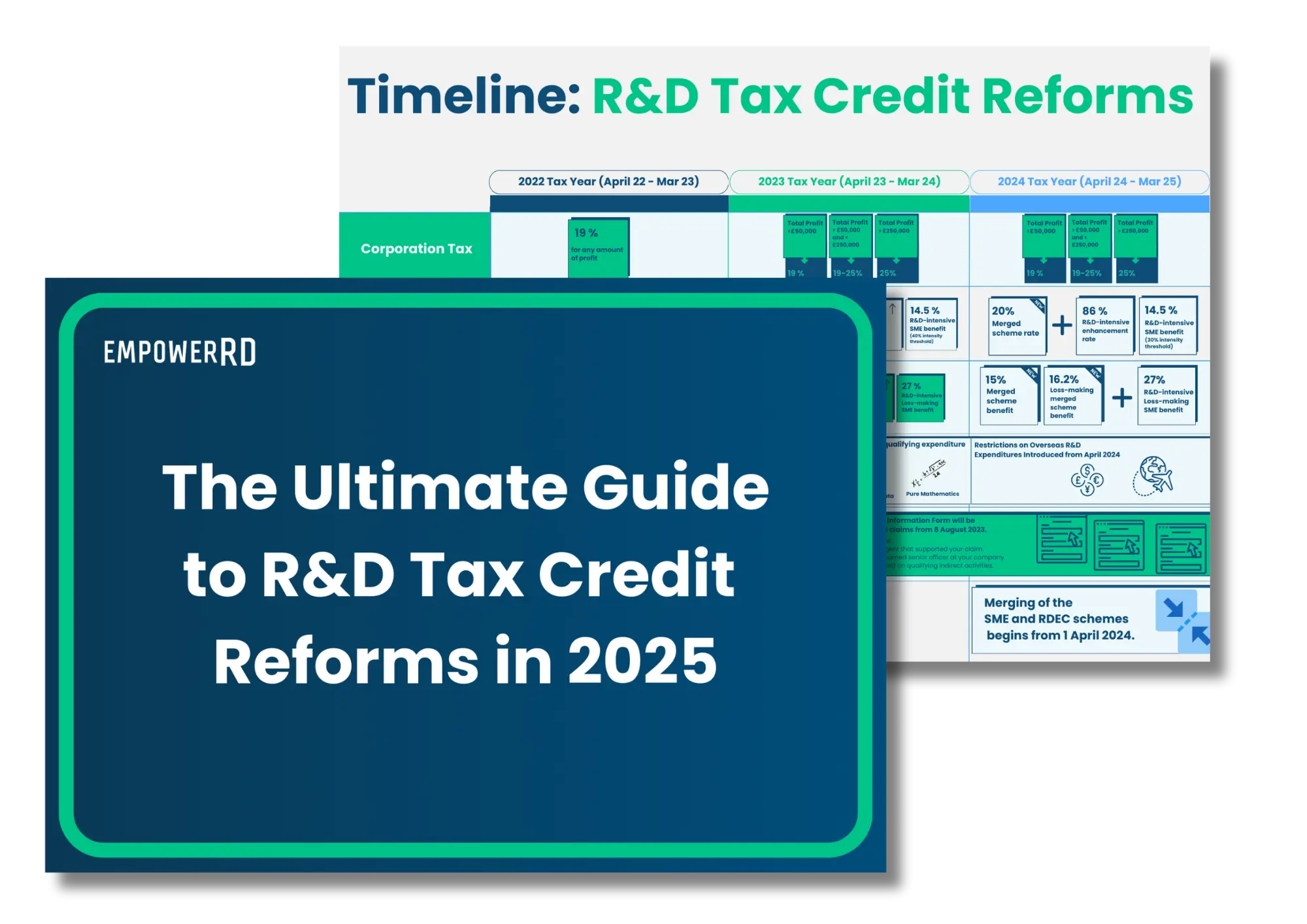

Recent R&D tax relief scheme changes require understanding to ensure future claims are successful.

Latest posts

Strategies to avoid HMRC enquiries in R&D tax credit claims

Navigating the complexities of R&D tax credit claims in 2024 requires a strategic approach to minimise the risk of HMRC enquiries. Companies must prioritise accuracy,

The role of expert R&D specialists in ensuring compliance

More than ever, navigating the complexities of R&D tax credits demands the guidance of experts. Specialist R&D advisors are essential, providing invaluable insights into interpreting

What is Innovation?

In a time where AI and Machine Learning are unlocking new horizons in business, it is crucial for companies to grasp the importance of understanding

The state of R&D tax credit enquiries

As we step into 2024, it’s important to acknowledge the evolving landscape of R&D tax credit claims, which now demand more attention. HMRC has implemented

R&D tax credits and Artificial Intelligence (AI): Emerging technologies and qualifying criteria

Last year, artificial intelligence (AI) garnered significant attention, leading to a surge in companies seeking R&D tax credits for their AI initiatives. However, the complex

Companies house reform: What you need to know

If you’re an accountant or business owner, you may be familiar with the recent developments at Companies House. In an effort to enhance transparency and