An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingThe EmpowerRD Blog

Insights and ideas to enrich your innovation, navigate the complex funding landscape, and enhance the quality of your R&D tax credit claims.

What the Autumn Budget 2025 Means for UK Innovation

R&D tax relief statistics 2025: claims fall 26% while innovation spend holds steady

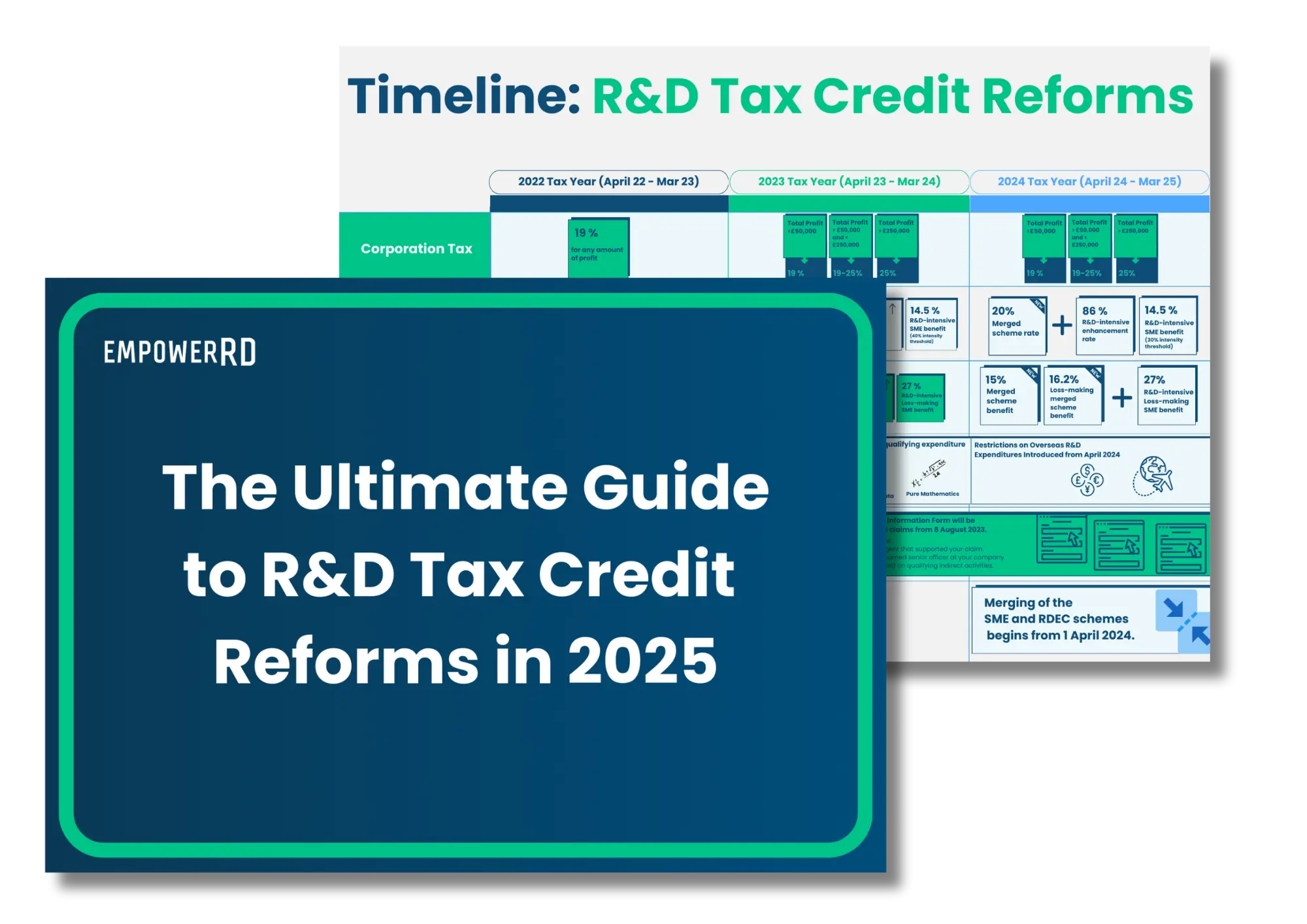

Recent R&D tax relief scheme changes require understanding to ensure future claims are successful.

Latest posts

How much should UK scale-ups invest in R&D: guidance for CFOs and founders

Investment benchmarks: £1.46 million and 12% intensity Interested in seeing how your businesses R&D budget compares? According to our UK Innovation Report 2025, medium-to-large companies

Elsbury v The Information Commissioner: Tribunal Orders HMRC to Reveal Its Use of AI

A landmark tribunal ruling In early August the First‑tier Tribunal (General Regulatory Chamber) handed down a judgment in Elsbury v The Information Commissioner [2025] UKFTT

Investor insight: Why 92% say R&D is vital to growth

R&D is no longer a back-office function. For UK startups and scale-ups, it is the frontline of growth, and investors know it. According to our

Why 1 in 4 scale-ups faced an HMRC enquiry last year

1. R&D is vital, and scrutiny is rising R&D tax credits are one of the UK’s most important incentives for innovation. It supports growth in

The UK Innovation Report 2025 – 5 things every founder needs to know

The UK innovation landscape is shifting fast. Despite economic pressures and global disruption, scale-ups are continuing to prioritise R&D, but regulatory complexity and HMRC scrutiny

HMRC’s R&D compliance efforts are working but what comes next?

A new low for error and fraud: what does it mean for innovators? For the second consecutive year, HMRC’s annual report, published on the 17th