An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingThe EmpowerRD Blog

Insights and ideas to enrich your innovation, navigate the complex funding landscape, and enhance the quality of your R&D tax credit claims.

What the Autumn Budget 2025 Means for UK Innovation

R&D tax relief statistics 2025: claims fall 26% while innovation spend holds steady

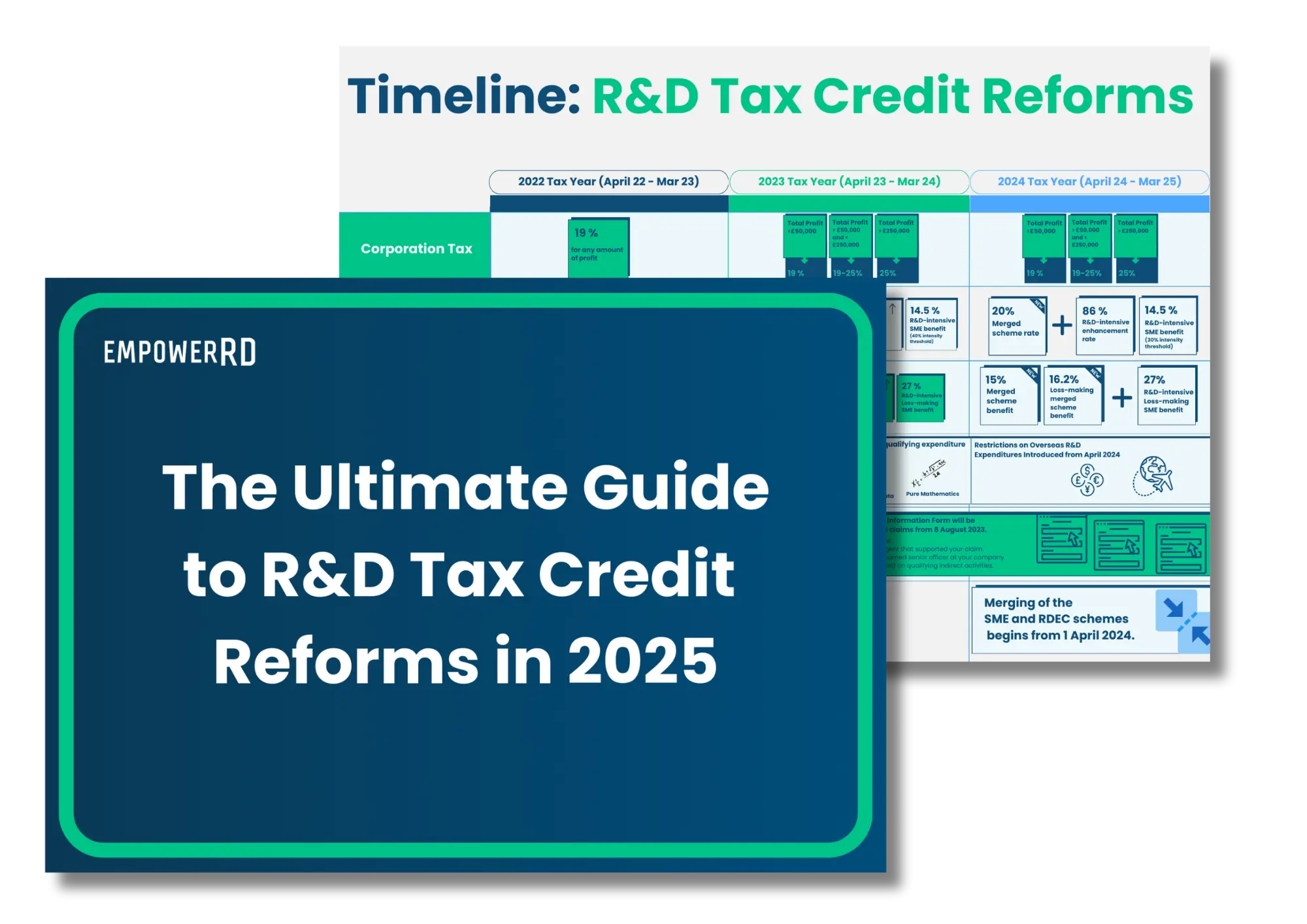

Recent R&D tax relief scheme changes require understanding to ensure future claims are successful.

Latest posts

EmpowerRD appoints Stuart Millar as Head of Tax

London – 23rd June 2025: EmpowerRD, the technology firm helping UK businesses navigate the complexities of R&D tax credit claims, has appointed R&D tax leader

Meet the Experts: Yasmin Lakin, R&D Financial Consultant

We sat down with Yasmin Lakin, one of EmpowerRD’s R&D Financial Consultants to learn more about her approach to claim reviews, what drew her to

Missed your R&D claim notification? HMRC offers a lifeline

If you thought you’d lost out on claiming R&D tax credits because you’d missed the deadline for submitting the Claim Notification Form (CNF), some good

HMRC’s new guidance on subsidised and subcontracted R&D – What SMEs need to know

On 27 February 2025, HMRC finally updated its guidance on subcontracted and subsidised R&D, addressing the long-standing confusion for SMEs claiming under the SME and

Spring Statement 2025: Key takeaways for innovative companies

Delivered minutes after the OBR downgraded growth forecasts this year from 2% to 1%, yesterday’s Spring Statement was about restoring some economic credibility and getting

Mastering R&D tax audits: How to help clients navigate HMRC scrutiny

Scrutiny of R&D tax credit claims has intensified recently, with HMRC reviewing 20% of all R&D claims in 2024, which is 5 times more than