An update from our Chief Client Officer, Max Glennon, on the latest changes affecting the UK’s R&D tax credit scheme.

This month:

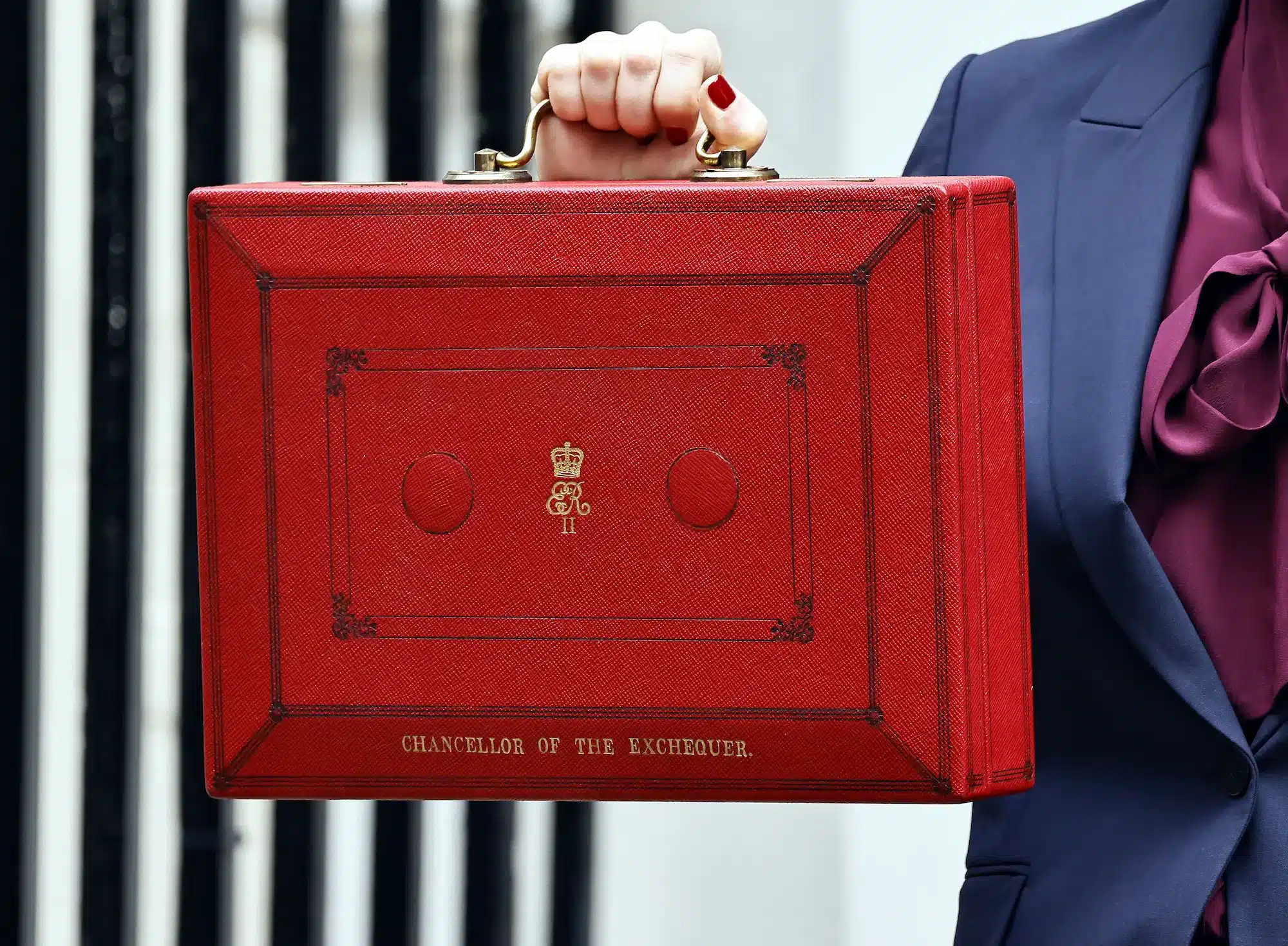

- Max looks at the Spring Budget on 15 March, addressing two key takeaways that directly affect the R&D tax relief:

- 1. The announcement that there will be additional tax relief for R&D-intensive SMEs.

- 2. The announcement that there will be a delay to restrictions on overseas R&D expenditure to 1 April 2024 instead of 1 April 2023.

- He also looks forward to EmpowerRD’s Spring Budget R&D debrief on 23 March at 10 AM. Max and our Head of Tax, Jon Yeomans, will look in-depth at the key takeaways from the budget, assessing how they might materially affect your future R&D tax claim.

Seeking a trusted partner to help you build your R&D tax claim?

We’re here to help. Over 900 UK companies have trusted EmpowerRD’s R&D platform and specialists to help them build optimised, compliant R&D tax claims. Please get in touch with one of our experts today if you have any further questions.