An agile platform to adapt to changing regulations. A team of R&D tax claim and sector specialist: ex-HMRC, ATT qualified, AML trained, AML registered and supervised by HMRC.

Book a MeetingThe EmpowerRD Blog

Insights and ideas to enrich your innovation, navigate the complex funding landscape, and enhance the quality of your R&D tax credit claims.

What the Autumn Budget 2025 Means for UK Innovation

R&D tax relief statistics 2025: claims fall 26% while innovation spend holds steady

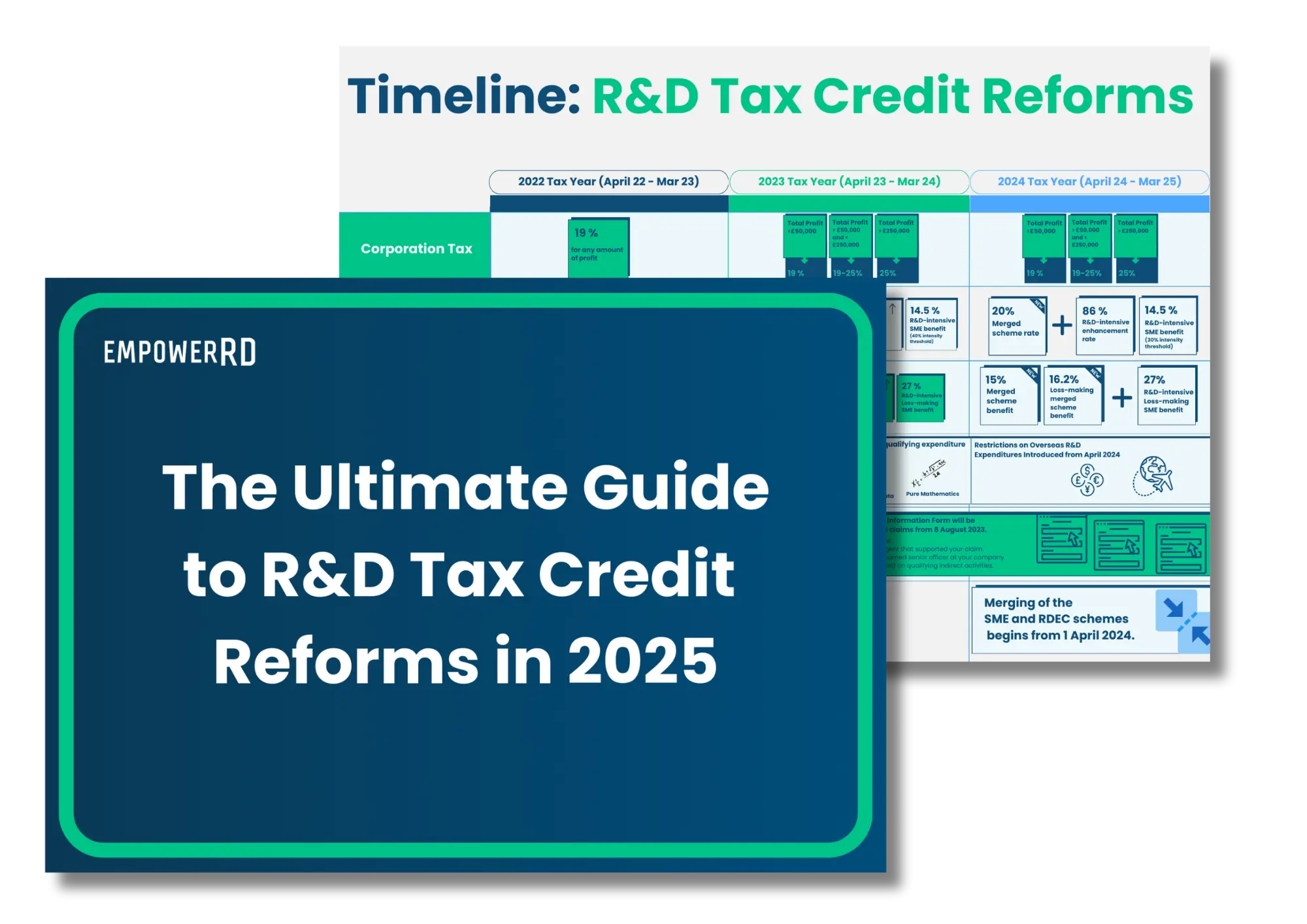

Recent R&D tax relief scheme changes require understanding to ensure future claims are successful.

Latest posts

5 essential steps for SMEs to navigate the Merged R&D Tax Credit Scheme

The R&D tax credit landscape has changed, and SMEs need to act fast. For accounting periods on or after 1 April 2024, the SME and

5 Tools to help you record and optimise your R&D tax credit claims

For innovative companies, R&D tax credits can be the key to unlocking growth, but the claims process can be complicated. Tracking qualifying activities, managing costs,

Building a culture of compliance: The way to R&D tax claim success

This is the second in our series of articles to help you get the most out of your R&D tax credit claims in 2025. Today,

From chaos to clarity: Building a robust R&D recordkeeping system

This article is the first in a series designed to help you optimise your R&D tax credit claim in 2025. Whether you’ve just completed your

EmpowerRD’s 2025 insights: The future of innovation and R&D tax credits

Want to know what’s in store for R&D in 2025? Our leadership team at EmpowerRD shares their expert predictions on the trends that will shape

2024: A year of stability and growth in R&D tax relief

The past few years have brought significant shifts to the R&D tax relief landscape, leaving many companies navigating newfound compliance requirements and rate adjustments. But